FAQ How to Trade (working)

Trading Overview

What am I trading?

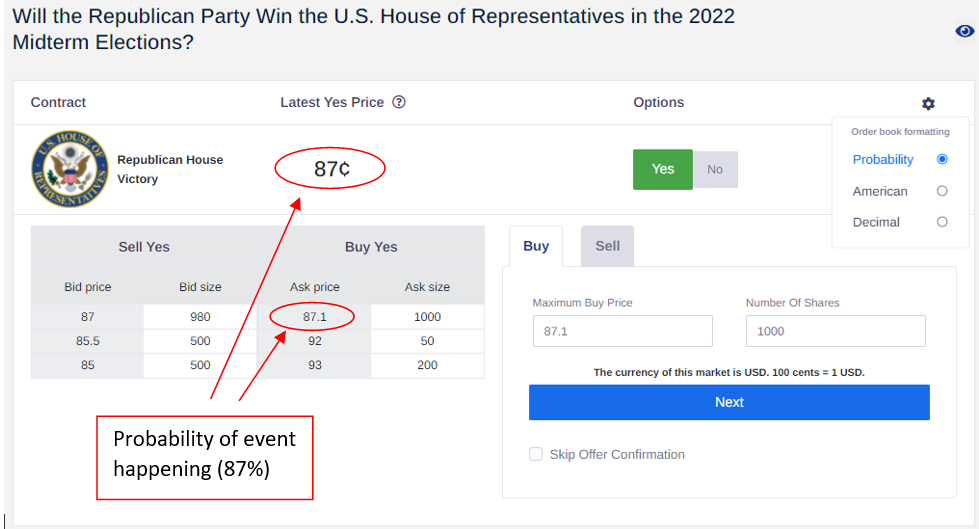

Insight Prediction allows you to trade binary options, contracts which range between .1 and 99.9 cents in price, and pay off one dollar if the conditions are satisfied and zero otherwise. A "Latest Yes Price" of 87¢ indicates that the event has an 87% chance of happening. If you buy one share of the "Yes" contract at 87¢, and it happens, you will be paid $1.00, with a 13¢ profit (14.9%).

The value of these contracts fluctuates over time reflecting the beliefs of users as they trade. You can offer to sell your contracts at any point before the markets resolves. Note that if your shares have gone up in value, you may decide to sell in order to guarantee profits. Conversely, if your shares go down in value you may decide to sell in order to prevent further loss. Alternatively you can hold onto your shares until the market resolves. At that point, if the event in the market has taken place, Insight Prediction will value "Yes" shares at $1 and "No” shares at $0. If it has not, "No" contracts will be valued at $1 while "Yes" contracts will go to $0.

How to use the order book

Insight Prediction uses an order book similar to a stock exchange. Order Books have “bids” and “asks”. The term "Bid price" refers to the highest price a buyer will pay to buy a specified number of shares while the term "Ask price" refers to the lowest price at which a seller will sell shares. The “Ask size” refers to the number of shares available to buy, and the "Bid size" refers to the number of shares available to be sold.

If you believe a market is more likely to resolve as “Yes” than the current best ask price then you can trade on this belief by buying shares at the lowest ask price available (87.1¢ in the case above). So, if I thought the Republicans had a greater than 87.1% chance of winning the House of Representatives, I could buy up to 1,000 contracts priced at $0.871 each, at a cost of 1,000*.871 = $871 (shares*price = cost).

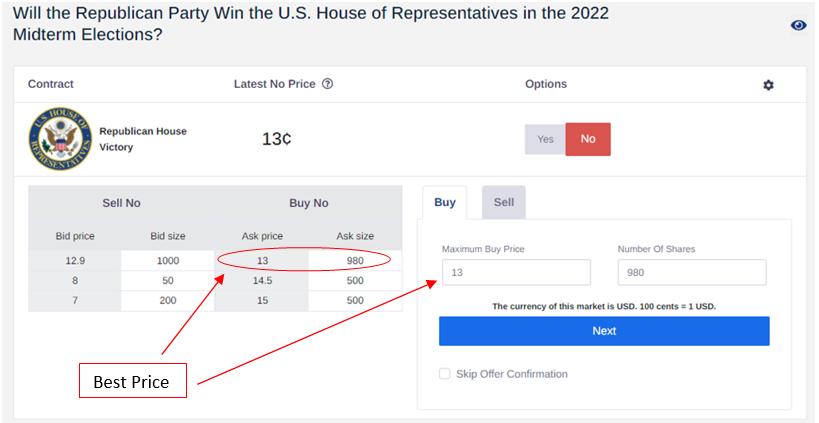

Alternatively, If I thought the Democrats were undervalued at 13%, I would want to buy “No” contracts. To buy “No” contracts simply click the “No” button under options, fill in the lowest ask price and the number of contracts I wanted to purchase and clicking the "Next" button.

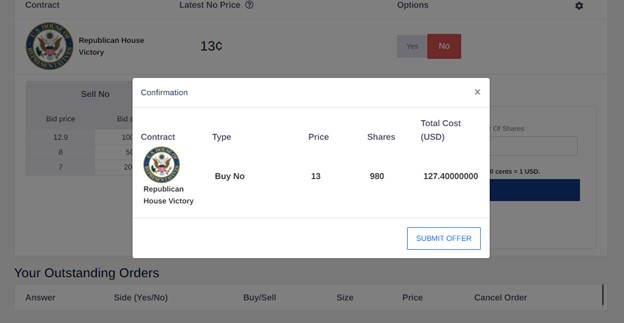

After clicking the blue “Next” button you’ll be shown the number of shares, price of the shares, and the total cost of the order. To complete the trade simply press the “Submit Offer” button.

How to sell shares I have already purchased

If you first buy "yes" shares, then there are two ways to sell. The first is to click on the "sell" button to sell your yes shares. Alternatively, you can buy "no" shares, and your yes and no shares will automatically cancel. Conversely, if you first buy "no" shares, you can either sell your no shares, or buy yes shares, and they will cancel. Below we show what happens if you try to sell yes shares before you have any: you will get a "You don't have shares to sell" error message.

How to place a resting (or "maker") order

If you are interested in buying shares at a lower price then they are currently offered you can place a resting-order at a price of you choice. Let’s say I want to bet that the Republican Party will win the House, but I think that 87% is too high of a probability and I’m only willing to buy at 83%.

I could place a resting-order to buy at 83% by filling in the order tab with the price and quantity of my choosing.

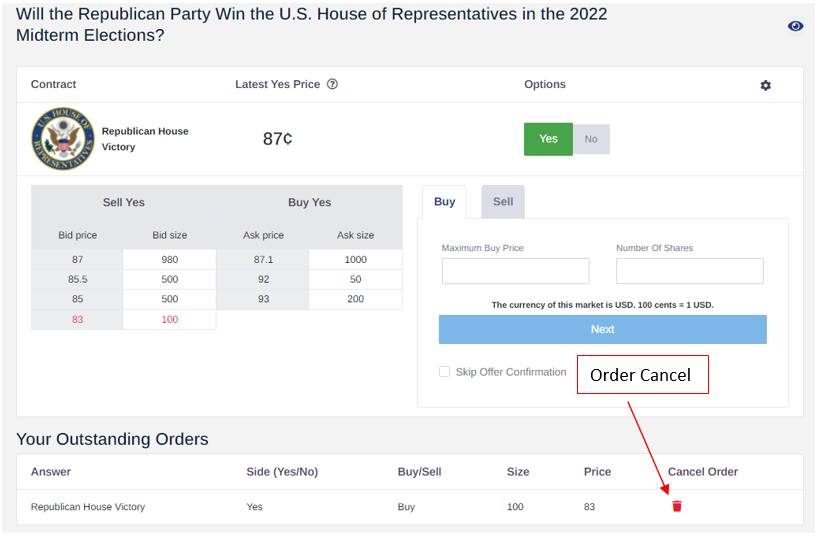

After submitting your offer, the Resting-order will be added to the order book and other users will have the opportunity to fill that order if they so choose. The order will show up for you in red in the orderbook (see below).

Can I cancel trades and orders I place?

Once a trade is executed, that trade is final and cannot be canceled. Once an order is placed it can be canceled at any point. To cancel an order go to the market of the page you'd like to cancel an order on (to find which markets you have orders on, you can go to the “My Markets Tab”). All markets in which you have placed an order will appear there. You can then click on the market, scroll down to “Your Outstanding Orders” and click the trashcan icon to cancel. Can I cancel trades and orders I place?

I am used to European or American Odds. Is there a way to switch?

On our platform, you can toggle between our own "probability" odds, formatted in cents, and European decimal odds, or American odds. Note that the trades themselves, and the latest yes price have to be placed in our own probability odds formatted in cents, but you can view the orderbook in terms of either European or American odds by clicking the settings button to the right of "Options".